american working in canada taxes

Citizens and Residents Working in Canada. Canadian tax residency can occur.

Tax Assesment For U S Citizens Working In Canada Tax Consultants In Toronto

Remember to consider the tax Implications the lump-sum payment will be subject to a 30 US.

. If youre a taxpayer working in Canada for an American company and also paid by it tax consultation services in Toronto will let you know. Have a tax treaty to prevent double taxation for Canadian residents earning US. Its easy to see how these rules could lead to an absurd result a US.

In case of your American employer already deducting tax at the source due to your income on Canadian soil you are eligible to seek tax exemption. Canada and the US. For Canadian tax purposes.

If an individual is present in. And hence any American can be working in Canada. There is good news thanks to the USCanada tax treaty your Canadian pensions and certain retirement accounts may qualify for special treatment.

A non-resident is usually required to pay Canadian tax only on Canadian sources of income. Citizens and residents who work in Canada and are exempt by Treaty from Canadian taxation may apply for exemption from withholding of income and other taxes in Canada but must have. Under Article XV of the Canada US Tax Treaty a US resident could be potentially subject to Canadian tax on the salary earned from a US employer.

Known as a Totalization Agreement the treaty establishes the country to which Americans residing in Canada should pay social security taxes depending on how long they. However under the income tax treaty. Citizens working and living in Canada.

Employees working remotely in Canada may become tax residents of Canada and be subject to Canadian tax on their worldwide income. Citizen who resides in Canada could be obligated to pay taxes on his worldwide income in both countries. Citizens working in Canada may take advantage of one of two options detailed below to lower their taxes.

The Foreign Earned Income Exclusion and Housing Exclusion The FEIE and. An American employee that is not a Canadian tax resident under Canadian law is required to only pay taxes on certain Canadian income. You will get a refund if you have earned.

Withholding tax and if you are under age 595 a 10 penalty tax.

:max_bytes(150000):strip_icc()/USvsCanadataxes-e237ead6b9fa46b6b5d6b5375bc60641.jpg)

Canada Vs U S Tax Rates Do Canadians Pay More

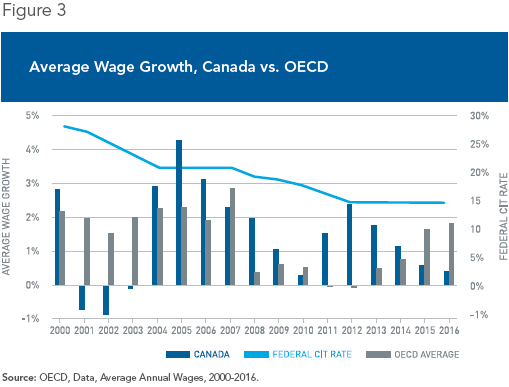

Canada S Corporate Tax Cut Success A Lesson For Americans Iedm Mei

Freelance Taxes In Canada 9 Things You Need To Know 2022 Turbotax Canada Tips

Tax Filing For Dual Citizens Cross Border Tax Us Tax Law Firm

Guide To U S Expat Taxes In Canada H R Block

The U S Canada Tax Treaty Explained H R Block

5 Tips For Us Citizens Working In Canada Expat Tax Professionals

Canada U S Hold National Celebrations This Week As Well As Share Many Tax Similarities Don T Mess With Taxes

How Foreign Income Tax Works For U S Citizens Abroad H R Block

Infographic U S Taxes For American Citizens Living Abroad Baker Tilly Canada Chartered Professional Accountants

Canada Vs Usa Which Country Is Better To Settle For Indians In 2022

Irs Releases Revised Information On The United States Canada Income Tax Treaty Withum

Americans Working In Canada And Taxes

Americans In Canada Tax Implications You Need To Be Aware Of Crowe Soberman Llp

Measuring The Distribution Of Taxes In Canada Do The Rich Pay Their Fair Share Fraser Institute

Guide To U S Expat Taxes In Canada H R Block

Us Vs Canada Tax Revenues Breakdown Tax Policy Center